LinkEye, the blockchain disrupting the credit service industry, has managed a 200% rally this week. Here’s the best place to buy LinkEye

One of the best performing cryptocurrencies in the market right now is LinkEye (LET), a credit industry disruptor with a host of real-world use cases. With obscure altcoins failing to secure gains in a bearish market, LinkEye’s practical uses have helped it rally by over 200% this week.

LinkEye is in the top 10 best performing cryptos today, and is perhaps the only high-performance crypto that has a real use case. Read on to find out how — and where — to buy this hidden gem.

How & where to buy LinkEye in the UK and elsewhere

LinkEye is a popular token and as such can be purchased from many of the most recognisable brokers and exchanges in the crypto sector. Start by choosing from our recommended partners below, before creating an account. Next, make a deposit into your digital wallet.

As soon as the funds show up in your account, just navigate to the LET market and make your first purchase.

eToro

eToro is one of the world's leading multi-asset trading platforms offering some of the lowest commission and fee rates in the industry. It's social copy trading features make it a great choice for those getting started.

CAPEX

CAPEX.com is an awarded fintech brand, globally recognized for a strong presence in shaping the future of trading. The company focuses on making the markets more accessible & transforming the way people trade online.

What is LinkEye?

LinkEye is an innovative blockchain solution to a fairly stagnant industry. Allowing for full transparency and consistency across the board, LinkEye improves the accuracy and efficiency of credit services by de-siloing credit blacklists and whitelists.

This has the potential to revolutionise credit, potentially allowing more people to get better access to credit, as well as excluding fraudulent actors, thus reducing the overall cost to consumers and the risk to creditors.

Should I buy LinkEye today?

With a series of higher lows and higher highs this week, LET looks to be charting fairly steady and sustainable gains. This means that there is possibly a longer bullish period ahead before a correction is felt.

With the pandemic in retreat and an economic recovery possible in the medium term, credit markets may return to pre-pandemic levels soon. This could very well be a boost for LET, as its use case becomes more relevant. The fundamentals and technicals of LET arguably point to a ‘buy’ signal.

LET price prediction

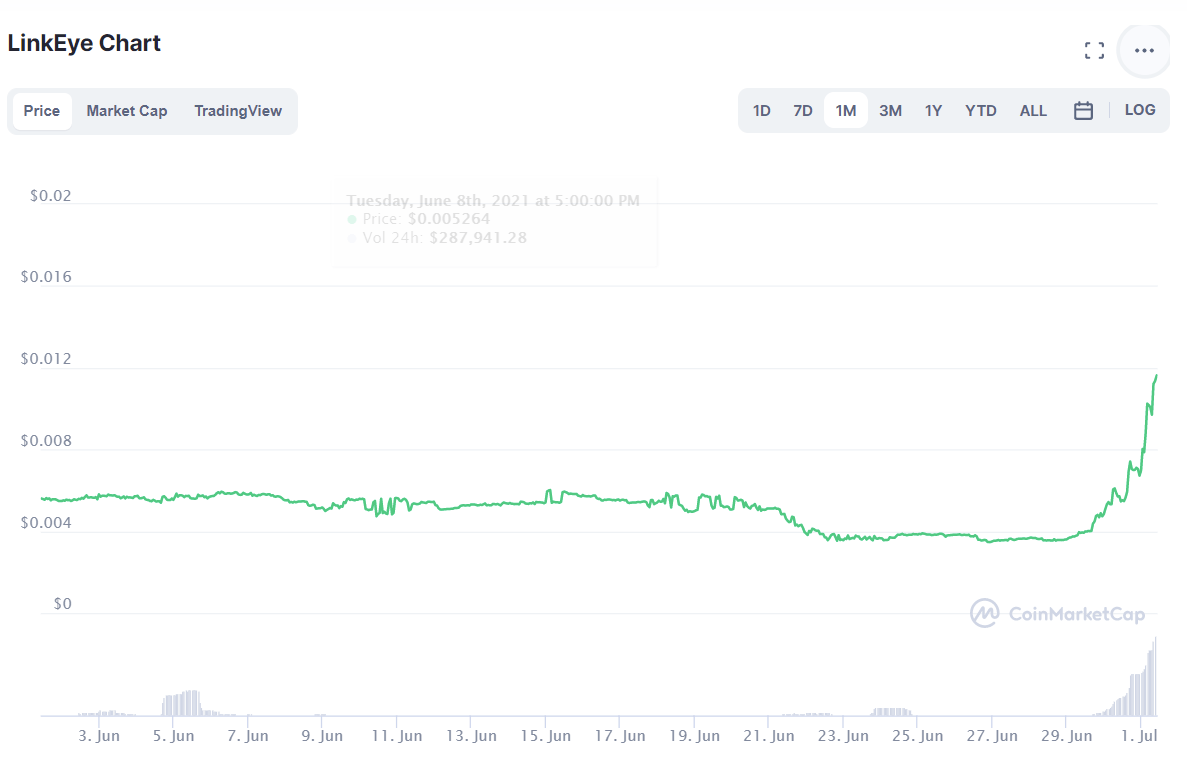

LET monthly chart. Source: CoinMarketCap

LET monthly chart. Source: CoinMarketCapLinkEye’s monthly chart appears to show that a market bottom has been formed and that a bullish recovery is now underway. Should bullish price action continue, the 3-monthly high region around $0.017 would be the next target for LET.

Currently at $0.01082, this gives plenty of room for profits to be locked in. Above the $0.017 target, the year-to-date high around $0.02173 gives a reasonable price prediction for the medium term.

English (US) ·

English (US) ·