The upcoming Magneto upgrade could catalyse a fresh upside for ETC price after a stellar second quarter.

Ethereum Classic price is up 3.8% in the past 24 hours, currently changing hands at around $44.82. The 17th ranked cryptocurrency has an intraday trading volume of $2,841,958,907, the sixth-highest in the market today.

While ETC’s price is 15% in the red over the past week, a new report shows that the Ethereum hard fork coin outperformed all the major cryptocurrencies by market cap during the last quarter.

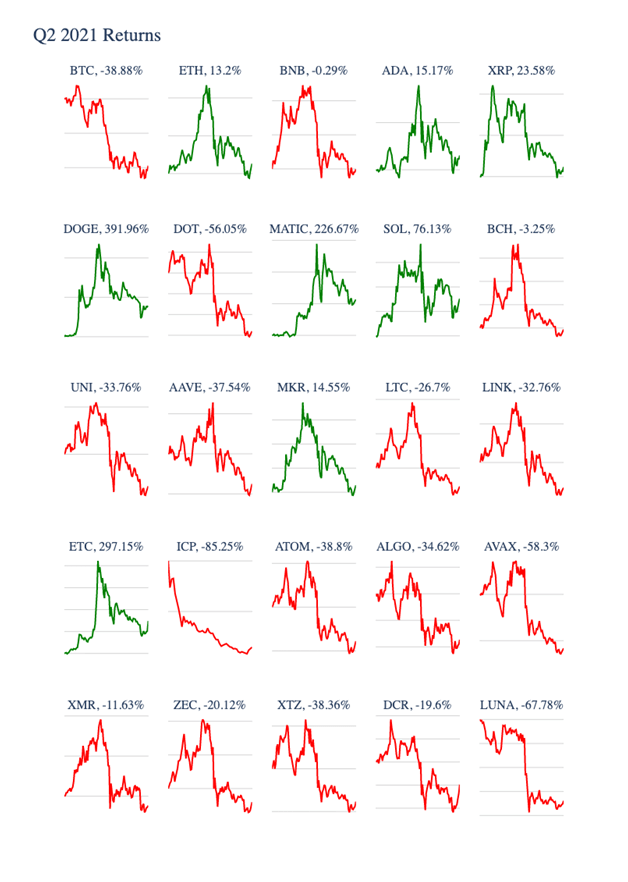

According to CoinMetrics’ State of the Network report, ETC price grew 297% between April and the end of June to outshine Bitcoin as bearish sentiment hit the market. Per the report, the price of Bitcoin shrunk nearly 39% in Q2, even as Ethereum Classic among other altcoins benefitted from a potential capital rotation.

Only ETC, alongside Dogecoin (DOGE) +326% and Polygon (MATIC) +226%, registered triple-digit gains to lead the market over the last quarter.

ETC was among the top three performers last quarter. Source: CoinMetrics

ETC was among the top three performers last quarter. Source: CoinMetricsCan the ETC price rebound higher?

Even with the May-June price crash, ETC still boasts impressive year-on-year gains. CoinGecko data shows that ETC/USD surged to an all-time high of $167 on 6 May, before widespread bleeding wiped off most of the gains.

As of writing, the altcoin’s current price of $45 is nearly 73% down from the ATH reached in May. However, ETC/USD is 614% up since this time last year, and investors could see further gains in the short term if the bullish sentiments around the network’s upcoming Magneto upgrade acts as a fresh catalyst.

Save the date! July 20th is #EthereumClassic Independence Day. The Magneto hard-fork is also expected around this time. So, lets prepare to celebrate responsibility and update our #ETC node software! #Cryptocurrency #CryptoNews #Crypto pic.twitter.com/Uy44xjSxcA

— Ethereum Classic (@eth_classic) July 6, 2021

The Magneto hard fork is set to happen around 20 July and will include updates from Ethereum’s Berlin upgrade. The ECIP-1103 seeks improvements meant to optimise gas usage and transaction processing, boosting network performance and security.

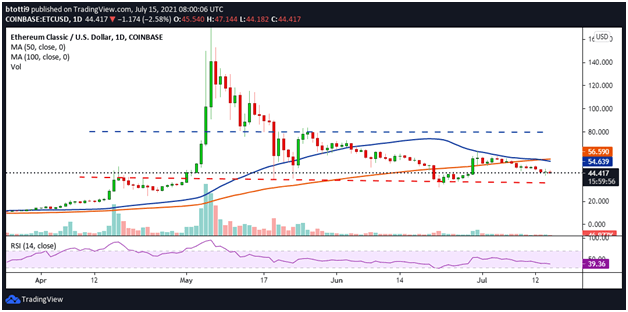

ETC daily chart

Looking at the charts, the daily chart, the ETC price is trading below both the 50 and 100-day moving averages and is hinting at an extension of the negative crossover formed in the past two sessions.

The 50 SMA is slightly sloped to suggest buyers face an uphill task if they attempt to reach the $54.65 price level. The 100 SMA is on the other hand suggesting an upturn, thus increasing the possibility of sideways trading, with the $56-$80 region forming a critical supply zone.

ETC/USD daily chart. Source: TradingView

ETC/USD daily chart. Source: TradingViewBut the RSI is bearish below the 50-mark, suggesting that the likely path for ETC could be downwards. If that happens, the Ethereum Classic price could decline below $40. The primary support levels in this case will be at $35.87 and $28.33.

English (US) ·

English (US) ·