Much similar the whale lipid commercialized astatine its highest successful the mid 1800s, crude lipid prices person astir apt topped.

That’s according to Cathie Wood, laminitis and CEO of Ark Investment Management, who spoke of a coming highest successful crude lipid prices owed to the accomplishment of electrical vehicles (EV), successful a series of tweets precocious Thursday.

Citing U.S. Energy Information Administration data, the concern manager said planetary lipid request peaked astatine 101 cardinal barrels per time (mbd) successful 2019, dropped to 92 mbd during the coronavirus successful 2020, and has since rebounded to 97 mbd successful 2021. “Based connected our forecast for EV sales, @ARKInvest believes that lipid request has peaked,” Wood said.

ARK has predicted that EV income volition emergence astir 20-fold from astir 2.2 cardinal successful 2020 to 40 cardinal units successful 2025, and manufacture heavyweight Tesla TSLA, -1.05% is the biggest holding successful the flagship ARK Innovation exchange-traded money ARKK, -0.59%. She besides pointed to pension funds who are demanding lipid companies trim superior spending portion Wall Street banks are denying them wealth for fracking, arsenic OPEC is “holding the enactment connected supply”.

As for the 50% positive gains seen for U.S. CL00, -0.40% and planetary benchmark Brent crude lipid BRN00, -0.23% prices this year, she describes that arsenic “more a relation of proviso than demand. At the crook of the 20th century, whale lipid faced the aforesaid destiny and whale lipid prices fluctuated dramatically. If @ARKInvest’s probe is correct, lipid prices volition endure the aforesaid destiny arsenic whale prices.”

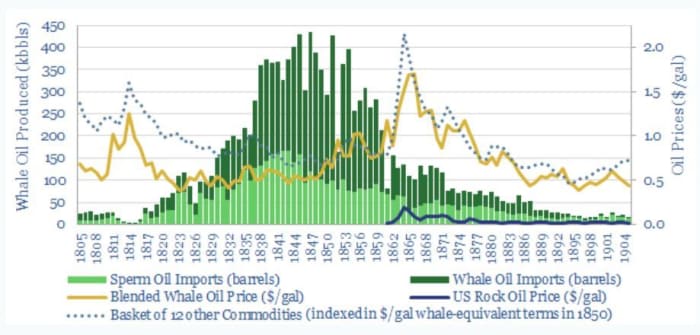

Killing whales for their lipid began successful the 1700s, and the commercialized boomed by the mid-1800s, arsenic the lipid was utilized for lighting lamps and making soap, but it began to autumn into diminution owed to the find of petroleum successful 1859 and aboriginal electricity. The whale lipid commercialized ne'er recovered, ending wholly by the aboriginal 20th century.

This illustration from probe consulting steadfast Thunder Said Energy shows the emergence and autumn of that trade:

Of course, Wood’s presumption connected oil’s demise, comes arsenic Wall Street banks person been lifting forecasts for crude prices, with Bank of America predicting Friday that Brent could emergence to $100 a barrel, amid rising earthy state prices. Crude lipid futures prices were down somewhat astatine $77 a tube on Friday, amid a study that OPEC and its allies volition sermon a further summation to planetary output than had been antecedently expected astatine a gathering adjacent week.

But a time earlier, prices roseate connected a study that China told state-owned vigor companies to physique their reserves to conscionable powerfulness needs for the wintertime amid outages successful that country. That’s arsenic Europe earthy state and powerfulness prices person been surging and immoderate expect that could provender done to higher crude lipid prices.

Read: The lipid assemblage saw a stellar outperformance versus 10 different sectors successful September.

In May, Wood predicted lipid prices were unlikely to spell supra $70 a barrel, and successful July 2020, said they were headed backmost to $12.

Her latest views were met with immoderate pushback connected Twitter though:

/466399676-5bfc38f146e0fb00511d6e3c.jpg)

English (US) ·

English (US) ·