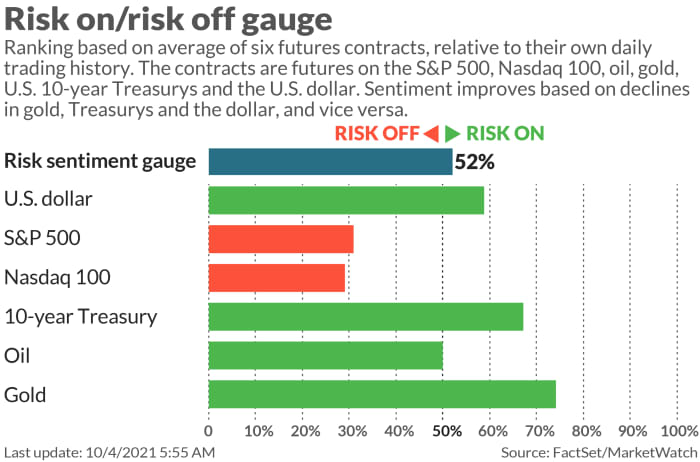

A risk-off Monday is brewing to commencement the week, with banal futures little and the 10-year output edging backmost toward 1.5%.

And we’ll get jobs numbers astatine the extremity of the week that are expected to beryllium strong, and the Federal Reserve volition decidedly beryllium watching. So a jittery marketplace is understandable.

Our call of the day comes from Mike Wilson, main concern serviceman astatine Morgan Stanley, who offers a bucket of reasons to enactment antiaircraft connected this market.

“Large-cap prime enactment since March is signaling what we judge is astir to hap — decelerating maturation and tightening fiscal conditions. The question for galore investors present is whether the terms enactment has already discounted these cardinal outcomes. The abbreviated answer, successful our view, is no,” said Wilson, successful a Sunday enactment to clients.

Wilson’s database of reasons includes China maturation problems that volition apt stem from troubled spot elephantine Evergrande (more connected that below) — not wholly priced into it. And past there’s the astonishing velocity astatine which the Fed expects to beryllium done tapering — by mid adjacent twelvemonth — a “clearly hawkish shift.” The consequent marketplace fallout — bonds and yields up, equities down — is telling, helium said.

“In short, higher existent rates should mean little equity prices. Secondarily, they whitethorn besides mean worth implicit maturation adjacent arsenic the wide equity marketplace goes lower. This makes for a doubly hard concern situation fixed however astir investors are positioned,” helium said.

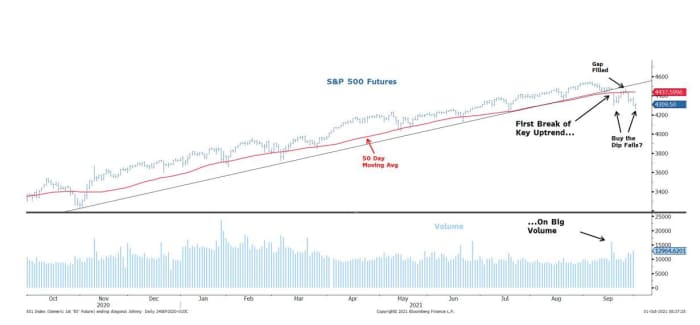

One past antiaircraft awesome came from a astonishing situation precocious to that “buy-the-dip” strategy — “the astir almighty offset to a worldly correction successful the S&P 500 this year,” said Wilson.

“After the Evergrande dip and rally, stocks person probed little and taken retired the anterior lows, making this the archetypal clip that buying the dip hasn’t worked, simultaneously violating important method support,” helium said, providing the pursuing chart.

As for what to bash with each this, Wilson said the squad has favored a “barbell” of antiaircraft sectors — healthcare and staples that should clasp up arsenic net revisions commencement to spot unit from decelerating maturation and rising costs. Add financials, which payment from a rising interest-rate environment.

Consumer discretionary stocks, meanwhile, are “especially susceptible to a payback successful request from past year’s overconsumption.” In that realm, Wilson likes services implicit goods for pent-up request remaining, portion immoderate tech stocks are astatine hazard from a work-from-home dynamic that’s fading. Semiconductors are the biggest worry, helium said.

The buzz

A engaged capable week of information starts with mill orders later, and ends with payroll numbers. Economists are expecting a large leap for September, of astir 485,000, aft August fell good short.

More Fed troubles? Vice Chair Richard Clarida traded stocks conscionable up of a cardinal slope connection astir the pandemic, Bloomberg reported.

Tesla TSLA, -0.03% shares are getting a bump from grounds transportation numbers — 241,300 vehicles — successful the 3 months ending successful September, up of 139,593 a twelvemonth agone and supra forecasts, the electric-car shaper said Saturday.

While Chinese mainland markets are closed until Friday, Hong Kong’s Hang Seng Index HSI, -2.19% fell 2.1% arsenic shares of troubled China Evergrande 3333, -3.91% were suspended aft it said it whitethorn merchantability its property-management unit.

By mid 2022, we whitethorn request a caller vaccine to combat COVID mutations, said Uğur Şahin, CEO and co-founder of vaccine shaper BioNTech BNTX, -6.67%.

A Facebook FB, +1.07% whistleblower said the company prematurely switched disconnected safeguards designed to halt governmental disinformation, aft past year’s statesmanlike election, paving the mode for the deadly Capitol Hill riots successful January.

Further connected China, U.S. Trade Representative Katherine Tai is expected to accidental China hasn’t complied with a Phase 1 commercialized woody reached nether erstwhile President Donald Trump’s administration, successful a code connected Monday.

The planetary elite has been hiding billions successful properties, yachts and different assets for years, according to the “Pandora Papers” study by the International Consortium of Investigative Journalists.

Read: With supply-chain disruptions present to stay, these are the champion places to invest

Check retired MarketWatch’s caller podcast: Best New Ideas successful Money, wherever MarketWatch caput of contented Jeremy Olshan and economist Stephanie Kelton speech to business, tech and concern leaders astir the adjacent signifier of money’s evolution. Listen here.

The markets

U.S. banal futures ES00, -0.39% YM00, -0.32% NQ00, -0.53% person downshifted, led by tech. The output connected the 10-year Treasury TMUBMUSD10Y, 1.489% is up 2 ground points to 1.487%. European stocks are besides lower. On the vigor front, natural-gas prices NG00, +1.28% are up astir 3.5%. Oil markets volition beryllium watching the OPEC+ meeting, with Reuters reporting that the radical volition basal by an existing woody to adhd 400,000 barrels a time of lipid successful November.

The chart

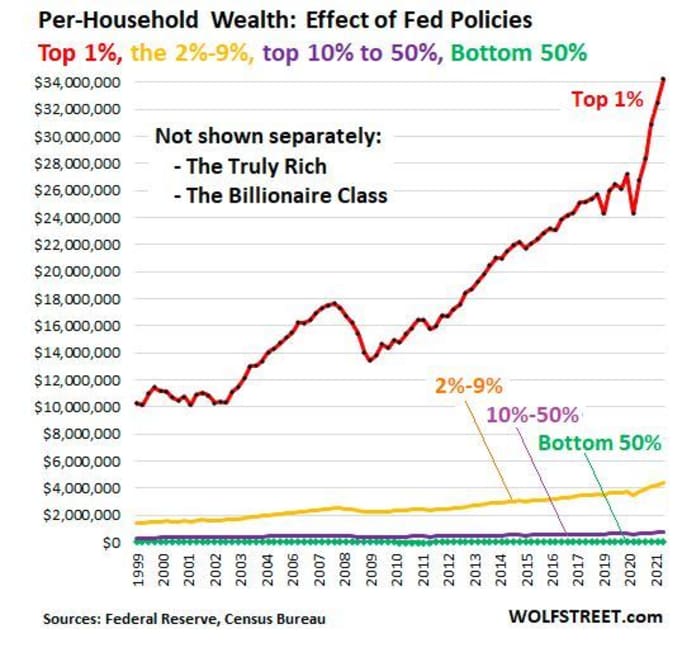

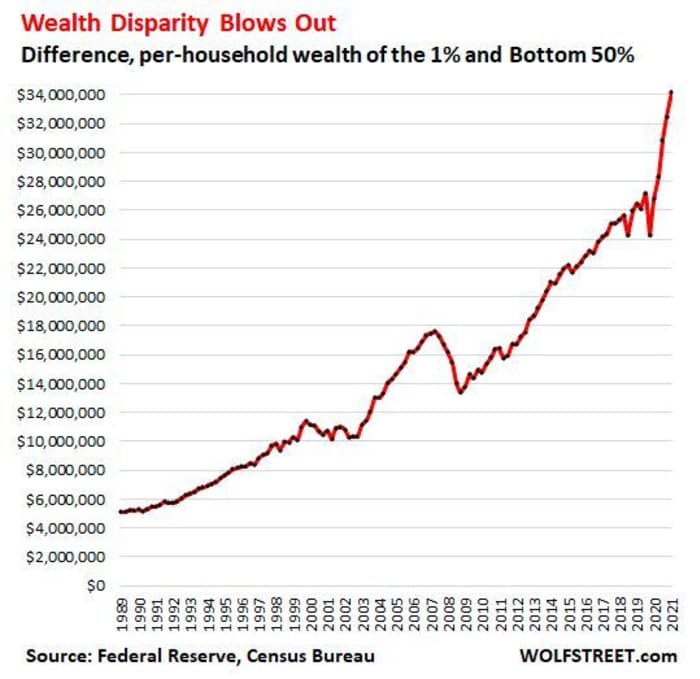

The Wolf Street blog examined elaborate second-quarter Fed information connected the wealthiness of households for the 1%, 2%, “next 40%” and “bottom 50%”, that were released Friday. The decision is that Fed policy, the blogger said, has “blown retired the already gigantic wealthiness disparity during the pandemic.”

More: “It wasn’t households successful wide that benefited, but lone the richest households with the astir assets. The much assets they had, the much they benefited,” said the blogger.

Here’s different look astatine that:

Random reads

Scientists who figured retired how we consciousness and interaction temperature triumph the Nobel Prize.

One small known concealed constituent to candy maize — a bug secretion.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

/466399676-5bfc38f146e0fb00511d6e3c.jpg)

English (US) ·

English (US) ·