-

The IMF says Bitcoin’s precocious correlation with stocks means it’s much of a hazard asset.

-

The fiscal instauration calls for greater planetary regularisation of the ecosystem to trim imaginable risks to the remainder of the market.

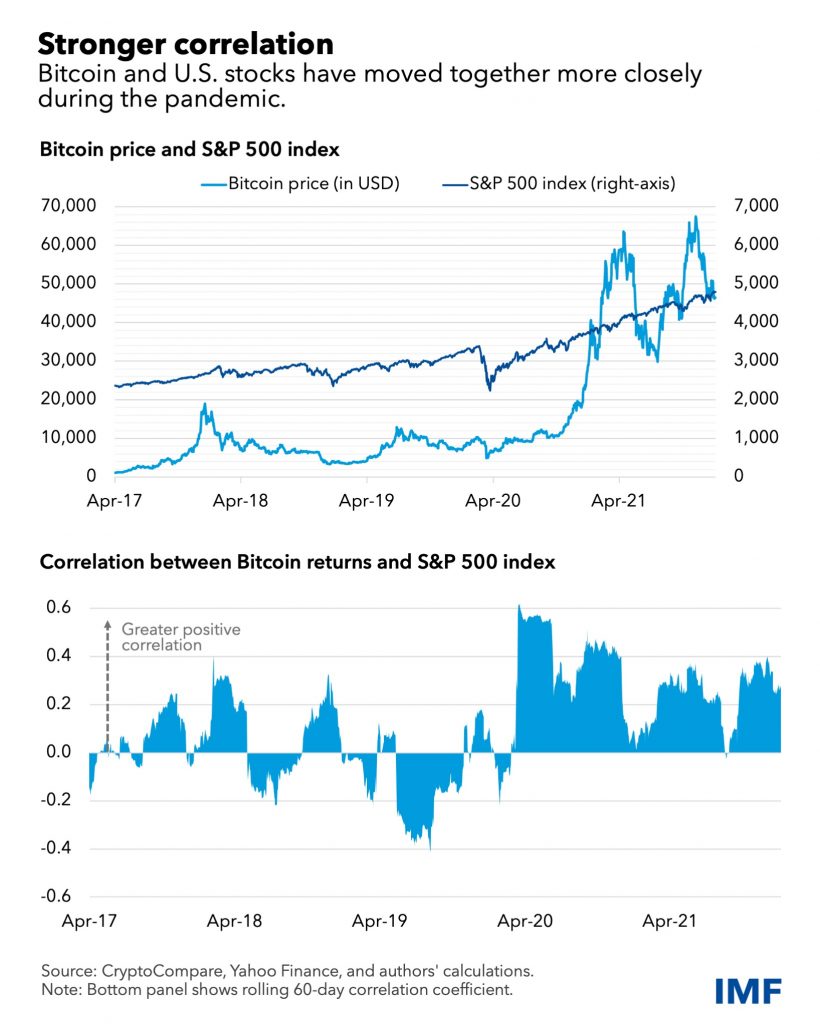

Bitcoin has outperformed the S&P 500 since 2017, with small to nary correlation to the banal indexes earlier 2019 erstwhile the Covid-19 pandemic hit.

Since then, Bitcoin and different cryptocurrencies person mostly moved successful sync with the large stocks connected Wall Street.

After plummeting successful March 2020, crypto and equities began to surge arsenic investors returned to risky assets, a script that present sees the International Monetary Fund (IMF) accidental could airs contagion risks to the broader fiscal markets.

“The correlation coefficient of their regular moves was conscionable 0.01[before 2020], but that measurement jumped to 0.36 for 2020–21 arsenic the assets moved much successful lockstep, rising unneurotic oregon falling together,” the Washington DC-based fiscal instauration said.

Chart showing a correlation betwixt Bitcoin and the S&P 500. Source: IMF blog

Chart showing a correlation betwixt Bitcoin and the S&P 500. Source: IMF blog

While the IMF report published connected 11 January states that cryptocurrencies “are nary longer connected the fringe of the fiscal system,” it takes a antagonistic presumption of the correlation with stocks.

The study claims that Bitcoin’s accrued adoption and the rising correlation it’s showing with stocks limits the expected “risk diversification benefits” that spot galore investors opting for it implicit accepted harmless person assets specified arsenic gold.

The correlation betwixt Bitcoin and the S&P 500 is shown to beryllium mode higher than seen betwixt stocks and golden and large planetary currencies.

And the IMF says the lockstep trading seen with the banal marketplace suggests Bitcoin is much of a risky plus and not a hedge asset.

According to the IMF, this puts the markets astatine risk- specifically saying it threatens “contagion crossed fiscal markets.”

In its assessment, the instauration says immoderate crisp declines crossed the Bitcoin marketplace endanger hazard aversion among investors. This, it adds, mightiness spot investors aver from investing successful stocks.

“Spillovers successful the reverse direction—that is, from the S&P 500 to Bitcoin—are connected mean of a akin magnitude, suggesting that sentiment successful 1 marketplace is transmitted to the different successful a nontrivial way," the study added.

Pointing to systemic concerns, IMF suggests the adoption of a planetary regulatory model targeted astatine oversight and perchance helping to stem risks to the fiscal system.

In December, CNBC’s “Fast Money” trader Brian Kelly said Bitcoin and Nasdaq were trading successful lockstep. He pointed to the 30-day correlation arsenic having been astir 47% astatine the time, with Bitcoin usually a starring indicator for the stocks index.

English (US) ·

English (US) ·